The best finance management app can vary depending on individual preferences and needs. However, some of the top-rated apps in the market are Mint, Quicken, and Monarch Money, which provide users with various features like tracking expenses, budgeting, and investments.

Managing finances can be a daunting task for many, especially when juggling various accounts, investments, and expenses. With the rise of technology, numerous finance management apps have emerged in the market, providing users with a simpler way to handle their finances.

From tracking expenses, setting budgets, managing bills to investments, these apps offer various features to help individuals stay on top of their finances. We will explore some of the top-rated finance management apps like Mint, Quicken, and Monarch Money, their features, and how they can help individuals streamline their finances.

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Credit: www.investopedia.com

Top Alternatives To Mint Budget App

Mint is a popular budgeting and expense tracker app. However, there are other apps out there that offer similar or even better features than Mint. Here are some top alternatives to Mint Budget App:

Copilot Money

Copilot is a free budgeting app that helps you keep track of your spending. It offers a user-friendly interface that allows you to create custom categories for your expenses and set spending limits. Copilot also offers insights into your spending habits and provides recommendations on how you can save money. Plus, it lets you sync your accounts and credit cards, making it easy to keep track of your balances and transactions.

Monarch Money

Monarch Money is a modern money management app that helps you track your spending, set and achieve financial goals, and plan for the future. It offers features like spending insights, bill reminders, and budget tracking, making it easy to stay on top of your finances. Additionally, Monarch Money allows you to link all your financial accounts and investments, and offers personalized investment recommendations to help you grow your wealth.

Pocketguard

PocketGuard is an all-in-one money management app that offers features like expense tracking, bill tracking, and savings goals. It also offers a unique feature called “In My Pocket,” which tells you how much money you have left to spend after taking into account your bills, savings goals, and spending habits. PocketGuard connects to your bank accounts and credit cards, making it easy to see your balances and transactions in real-time.

Quicken Simplifi

Quicken Simplifi is a budgeting app that helps you manage your money, track your spending, and achieve your financial goals. It offers features like expense tracking, bill management, and account syncing, making it easy to keep track of your finances. Quicken Simplifi also provides personalized insights and recommendations to help you save money and improve your financial wellbeing.

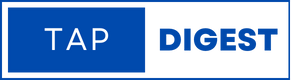

Rocket Money

Rocket Money is a personal finance app that helps you manage your money, track your spending, and achieve your financial goals. It offers features like budget tracking, bill management, and account syncing, making it easy to stay on top of your finances. Rocket Money also offers personalized insights and recommendations to help you save money and improve your financial health.

In conclusion, while Mint is a great budgeting app, there are many other options available. These top alternatives to Mint Budget App offer unique features and benefits, making it easy to find an app that fits your financial needs.

Credit: www.uplabs.com

Factors To Consider When Choosing A Finance Management App

Choosing the best finance management app requires consideration of factors such as budget, user interface, security, and features offered. It’s important to compare different options before settling for one that best suits your needs and goals.

Factors to Consider When Choosing a Finance Management App Finding a finance management app to meet your needs can seem overwhelming. With so many options available, it is essential to understand what factors to consider when making the right choice. Factors such as usability, features, security, and pricing should be carefully examined before selecting an app.Usability

A finance management app should be user-friendly and easy to navigate. It should provide you with an at-a-glance overview of your finances. Check the app’s user interface (UI) and user experience (UX) components. The app should be intuitive and easy to use. It should also support multiple platforms, from desktop to mobile devices.Features

The features of the app you choose should meet your specific financial needs. For example, if you have investments, you may want an app that provides investment tracking and portfolio management. If you own a small business, you may require an app with accounting features like invoicing, expense tracking, and budgeting. Make a list of the features you require and check which apps provide those features.Security

Security is a crucial factor to consider when choosing a finance management app. Your financial data is sensitive information, and it’s essential to ensure that the app you choose has robust security protocols. Look for apps that use data encryption and multi-factor authentication. Avoid apps that require you to share personal or financial information to use the software.Pricing

While there are free finance management apps available, they may lack essential features, or their security protocols may be less robust than other apps. Paid apps typically offer more features and better security, but it’s essential to ensure that the pricing structure aligned with your budget. Some apps may charge a monthly subscription fee, while others may charge annual fees. Some may require a one-time purchase. Compare pricing structures to ensure you find a plan that suits your needs. Overall, it’s essential to consider the usability, features, security, and pricing when choosing a finance management app. With so many options available, it’s crucial to take the time to research and compare before making a choice.

Credit: www.pcmag.com

Frequently Asked Questions For Best Finance Management App

What App Helps You Keep Track Of Your Finances?

The top finance management apps are Better than Mint, Quicken, Monarch Money, QuickBooks, and Sage. You can use them to track income, expenses, and investments. Some of these apps charge for premium services, but many offer free trials or free versions to test out before committing to them.

Ultimately, you need to decide which app works best for you and your financial goals.

Are Money Management Apps Worth It?

Subscription-based money management apps might be worth the monthly or annual fee for the premium services they offer, but it is important to test out their free version or free trial before committing. Consider apps like YNAB, Goodbudget, EveryDollar, or Mint.

What Is The Number 1 Budget App?

The number one budget app is a matter of personal preference. However, some popular choices include Mint, YNAB, Goodbudget, EveryDollar, and Simplifi by Quicken. Each offers unique features for tracking expenses and creating budgets to manage finances effectively. It’s worth checking out their premium services or free trials before making a decision.

What Is The Number One Financial App?

There is no single top financial app, but several popular ones available. Some of the best ones include Mint, Quicken, Monarch Money, EveryDollar, Goodbudget, and YNAB. Each of these apps has unique advantages and features, helping users with different financial needs and goals.

Conclusion

From our research, we identified some of the best finance management apps available in the market, including Mint, Quicken, Monarch Money, and NetSuite. Each of these options has unique features that cater to different financial needs. However, it is essential to note that not all apps are suitable for everyone, and it is crucial to consider the pricing model before committing to a subscription.

Finding the right finance management app can improve your financial health, and using any of the top-rated apps mentioned in this guide could be a wise decision.

Leave a Reply