Starting a fintech company can cost anywhere from a few thousand to several million dollars, depending on factors such as the scope of the project, technology requirements, regulatory compliance, and team size. However, the exact cost can only be determined ...

To get a job in FinTech with no experience, the key lies in first getting to know the industry and honing your skills. This often includes applying for internships, seizing opportunities, and networking with professionals in the field. Understanding Fintech ...

To get into Fintech, start by understanding what Fintech is and exploring the various career paths within the industry. Acquire the necessary skills and knowledge through relevant studies and internships, and build a network with professionals in the field. Stay ...

To create a fintech app, start by conducting thorough research and forming a team. Design a minimum viable product (MVP), select a tech stack, and design APIs for core functions. Next, focus on designing user-friendly UX/UI, launch the app, and ...

To start a fintech business, identify a high-need and underserved audience, solicit customer feedback, diversify revenue streams, determine infrastructure, formalize customer acquisition strategy, and test and iterate. Additionally, develop an idea, validate it, understand finance industry and technology regulations, determine ...

To invest in fintech, consider investing in technology itself or acquiring stock options with a fintech company. Another option is to choose fintech-related investments such as shares of stock or funds. Additionally, you can explore investment platforms and crowdfunding opportunities ...

International students are eligible for specialized private education loans available in the USA. Sallie Mae provides loans to qualifying international students with a US cosigner. Securing education loans as an international student can be challenging, but it is a necessary ...

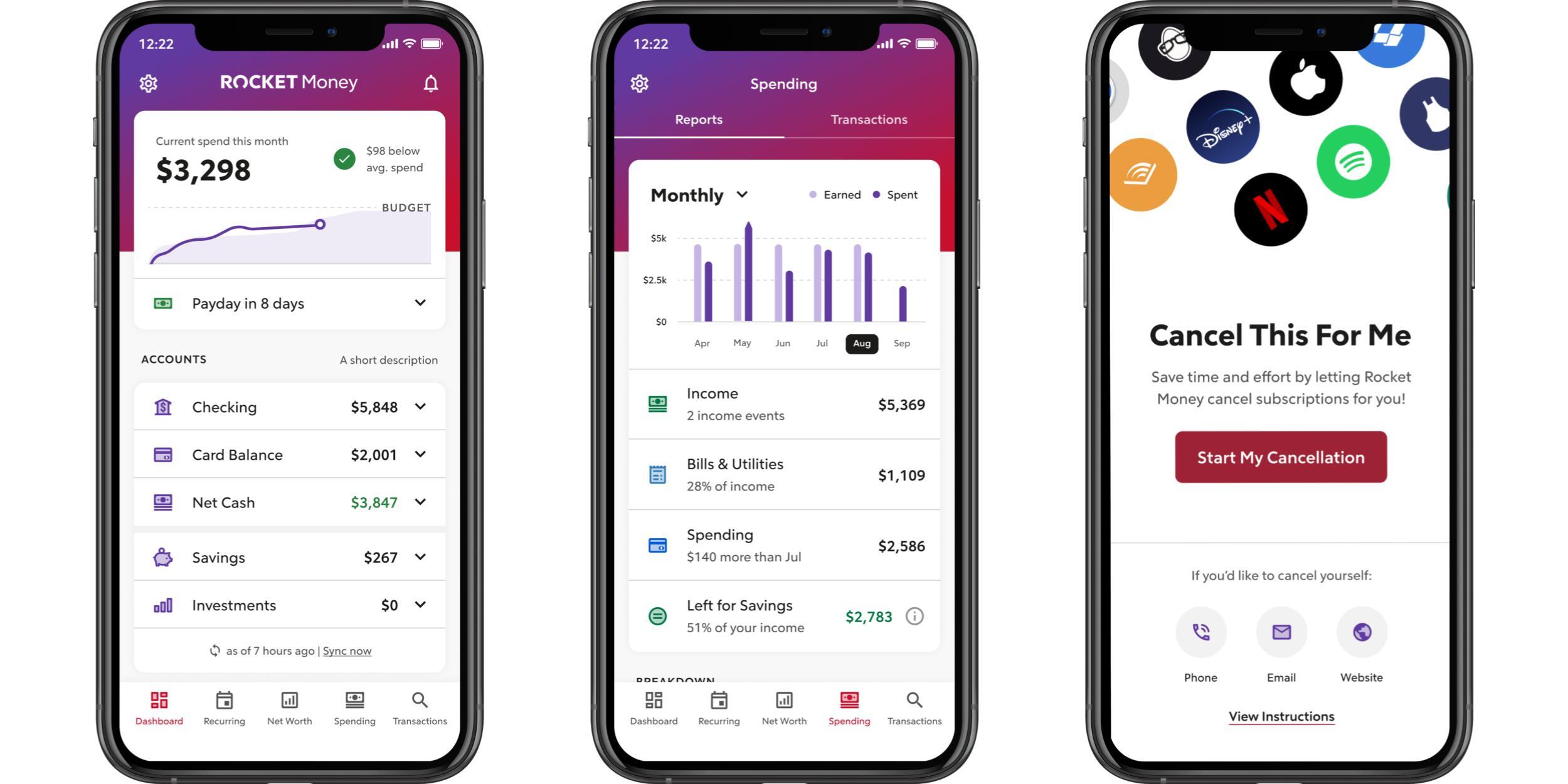

The best finance management app can vary depending on individual preferences and needs. However, some of the top-rated apps in the market are Mint, Quicken, and Monarch Money, which provide users with various features like tracking expenses, budgeting, and investments. ...