The best accounting software for real estate investors can vary depending on individual needs and preferences. However, QuickBooks is a popular choice among realtors for its ability to consistently track finances, set realistic goals, and create quarterly milestones.

QuickBooks Online Plus, Essentials, and Payroll Premium are some of the options offered by Intuit. Another notable software option is NetSuite, which provides an all-in-one solution for optimizing the general ledger, automating accounts receivable and payable, and managing financials in the cloud.

Other software options worth considering include Zoho Books, Northspyre, Lucernex, Yardi Breeze, and Rental Hero. These platforms offer features such as budget transparency, lease accounting compliance, rental accounting management, and customer relationship management.

Introduction To Real Estate Accounting Software

When it comes to managing the finances of real estate investments, specialized accounting software can make a world of difference. Real estate accounting software is designed to cater to the unique needs of real estate investors, providing tailored features and functionalities that are crucial for effectively managing real estate finances.

Why Specialized Software?

Real estate accounting involves complex transactions, including property acquisitions, rental income, property expenses, and more. Generic accounting software may not provide the specific tools and capabilities needed to handle these intricacies. Specialized software is tailored to the unique financial requirements of real estate investors, offering features such as property management, rental income tracking, expense categorization, and reporting functionalities that are essential for managing real estate finances.

Impact On Real Estate Investors

The use of specialized accounting software can have a significant impact on real estate investors. It streamlines financial operations, enhances accuracy, and provides comprehensive insights into the financial performance of real estate assets. This allows investors to make informed decisions, optimize their financial strategies, and maximize the profitability of their real estate portfolios.

Credit: realestatebees.com

Features To Look For

When choosing accounting software for real estate investors, it’s crucial to consider the specific features that will streamline financial management and ensure compliance. Here are some key features to look for:

Automation Of Key Tasks

Efficient automation of key tasks such as income and expense tracking, invoicing, and financial reporting is essential for real estate investors. Look for software that offers automated bank feeds, recurring invoices, and customizable financial reports to save time and reduce manual errors.

Compliance And Reporting

Real estate accounting involves complex regulatory requirements and reporting standards. The ideal software should offer features that ensure compliance with tax regulations, GAAP (Generally Accepted Accounting Principles), and real estate-specific accounting standards. It should also provide robust reporting capabilities for generating income statements, balance sheets, and cash flow statements.

Software Integration Capabilities

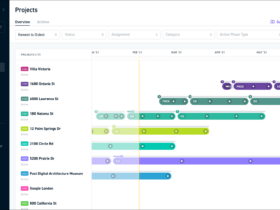

When it comes to accounting software for real estate investors, software integration capabilities play a crucial role in streamlining processes and increasing efficiency. The ability of accounting software to seamlessly sync with other tools and consolidate data is essential for real estate professionals looking to effectively manage their financial operations. Here, we explore two key aspects of software integration capabilities: syncing with other tools and data consolidation.

Syncing With Other Tools

One of the key advantages of modern accounting software for real estate investors is its ability to sync with other tools commonly used in the industry. Whether it’s property management software, customer relationship management (CRM) systems, or project management tools, integration allows for seamless data transfer, eliminating the need for manual entry and reducing the risk of errors.

By integrating accounting software with property management systems, real estate investors can easily track rental income, expenses, and tenant payments, all in one centralized platform. This integration ensures that financial data is accurate and up-to-date, enabling investors to make informed decisions about their properties.

Additionally, integrating accounting software with CRM systems allows real estate professionals to track leads, manage client information, and monitor sales transactions. This integration ensures that financial data is aligned with sales activities, providing a comprehensive view of the business’s financial health.

Data Consolidation

Data consolidation is a critical aspect of software integration capabilities in accounting software for real estate investors. It involves bringing together financial data from various sources and consolidating it into a single, unified platform.

By consolidating data from different sources such as bank accounts, credit cards, and property management systems, real estate investors can gain a holistic view of their financial standing. This allows for accurate reporting, budgeting, and forecasting, empowering investors to make strategic financial decisions.

Furthermore, data consolidation enables real estate professionals to identify trends, patterns, and anomalies in their financial data. This level of insight can help investors detect potential issues or opportunities, allowing for proactive decision-making and risk management.

In conclusion, software integration capabilities are essential for real estate investors when choosing accounting software. The ability to sync with other tools and consolidate data ensures streamlined processes, accurate reporting, and informed decision-making. By leveraging these capabilities, real estate professionals can optimize their financial operations and drive business success.

User-friendly Interfaces

When it comes to accounting software for real estate investors, having a user-friendly interface is essential. Real estate investors need software that is easy to navigate and understand, allowing them to efficiently manage their finances without the hassle of a complex system. In this section, we will explore the key aspects of user-friendly interfaces, including ease of use, training, and support.

Ease Of Use

One of the most important factors in choosing accounting software for real estate investors is its ease of use. The software should have a simple and intuitive interface that allows users to quickly navigate through different features and functions. This ensures that real estate investors can easily input and track their financial data, generate reports, and analyze their overall financial performance.

Here are some key features that make accounting software user-friendly:

- Intuitive dashboard: A well-designed dashboard provides a clear overview of the financial health of your real estate investments, displaying key metrics and summaries.

- Easy data entry: The software should offer a straightforward process for entering income, expenses, and other financial transactions, minimizing the time and effort required.

- Automated processes: User-friendly software includes automation features that streamline repetitive tasks, such as bank reconciliations and invoice generation.

- Customizable reports: Real estate investors need to generate reports that are tailored to their specific needs. The software should offer customizable reporting options to analyze cash flow, profitability, and other important metrics.

Training And Support

Another crucial aspect of user-friendly accounting software is the availability of comprehensive training and support. Real estate investors may have varying levels of accounting knowledge, so having access to resources that can help them learn and navigate the software is essential.

Here are some key features to look for in terms of training and support:

- Video tutorials: Visual learning is often more effective, so having access to video tutorials that guide users through the software’s features can be highly beneficial.

- Knowledge base: A well-organized knowledge base with FAQs and step-by-step guides can help real estate investors troubleshoot common issues and find answers to their questions.

- Customer support: Responsive customer support via phone, email, or live chat is crucial for real estate investors who may encounter technical difficulties or have specific inquiries.

- Community forums: Engaging with a community of other real estate investors who use the same software can provide valuable insights, tips, and best practices.

In conclusion, accounting software with user-friendly interfaces is essential for real estate investors. The ease of use and availability of comprehensive training and support can greatly enhance the efficiency and effectiveness of managing finances in the real estate industry.

Scalability For Growth

Achieving scalability for growth is crucial for real estate investors, and the best accounting software can make all the difference. With features tailored to the unique needs of real estate, such as property management and financial reporting, top solutions like NetSuite, Zoho, Northspyre, and Yardi Breeze empower investors to efficiently manage their finances and drive business expansion.

Real estate investors need accounting software that can grow with them. Scalability is key when it comes to managing a small portfolio and growing into a large one. The ability to adapt to market changes is also essential. Choosing the right accounting software can make all the difference in managing finances efficiently and effectively.From Small To Large Portfolios

As a real estate investor, you need accounting software that can handle both small and large portfolios. QuickBooks Online is a popular choice among real estate investors due to its scalability. It offers a range of plans to suit businesses of all sizes, from simple start-ups to more established enterprises. With QuickBooks Online, you can easily upgrade your plan as your business grows, ensuring that your accounting software can keep up with your needs.Adapting To Market Changes

Market changes can be unpredictable, and real estate investors need accounting software that can adapt to those changes. NetSuite® Accounting Software is an all-in-one solution that can help real estate investors stay on top of financial management in a constantly changing market. With NetSuite® Accounting Software, real estate investors can optimize their general ledger, automate AP, and optimize AR, all in one place. This accounting software is cloud-based, providing real-time financial data and insights, allowing investors to make informed decisions quickly. In conclusion, accounting software is an essential tool for real estate investors. It helps investors manage their finances efficiently and effectively. QuickBooks Online and NetSuite® Accounting Software are two excellent options for real estate investors looking for scalable accounting software that can adapt to market changes.Security And Data Protection

Ensure the security and data protection of your real estate investment with top accounting software. Streamline your financial management while keeping sensitive information safe and compliant. Invest in reliable software to safeguard your real estate assets and financial data.

Keeping Financial Data Safe

One of the most important considerations when choosing accounting software for real estate investors is the security and protection of financial data. With sensitive financial information such as bank account details, tax records, and investment information, it is crucial to ensure that the software being used has robust security measures in place to protect against cyber threats and data breaches.Regular Updates And Backups

Regular software updates and backups are essential for the smooth and secure running of any accounting software. Updates ensure that any bugs or vulnerabilities are fixed, and the software remains up-to-date with the latest security patches. Backups, on the other hand, ensure that financial data is protected in the event of a system failure or cyber attack. It is crucial to choose accounting software that offers automatic backups and updates to ensure the protection of financial data. When it comes to accounting software for real estate investors, security and data protection are non-negotiables. Keeping financial data safe and ensuring regular updates and backups are essential for the smooth and secure running of any accounting software. QuickBooks Online Plus and QuickBooks Online Essentials by Intuit are excellent options for real estate investors looking for secure and reliable accounting software.Cost Considerations

When it comes to choosing the best accounting software for real estate investors, cost considerations play a crucial role. It’s important to find a solution that not only meets your accounting needs but also fits within your budget. In this section, we will explore the various pricing structures and the differences between free and paid options.

Pricing Structures

Accounting software for real estate investors typically offers different pricing structures to accommodate varying business sizes and needs. Here are some common pricing structures you may come across:

- Monthly Subscription: Many accounting software providers offer a monthly subscription model, where you pay a fixed fee each month to access the software and its features. The subscription fee is usually based on the number of users or the level of functionality you require.

- Annual Subscription: Some software providers also offer an annual subscription option, which allows you to pay for the software upfront for a year of access. This option often comes with a discounted rate compared to the monthly subscription.

- Per Transaction: Certain accounting software may charge you based on the number of transactions you make within a given period. This pricing structure can be beneficial for real estate investors who have a low volume of transactions.

Free Vs. Paid Options

When it comes to accounting software for real estate investors, you have the option to choose between free and paid options. Here’s a breakdown of the key differences:

| Free Options | Paid Options |

|---|---|

|

|

While free options can be a good starting point for small real estate investors with basic accounting needs, paid options provide more robust features and support for growing businesses. It’s essential to assess your specific requirements and budget to determine which option is the best fit for your real estate investment business.

One popular accounting software option for real estate investors is QuickBooks. It offers a range of pricing plans to suit different business needs, including QuickBooks Online Plus, QuickBooks Online Essentials, and more. QuickBooks provides comprehensive accounting features and integration capabilities, making it a reliable choice for real estate professionals.

Ultimately, the right accounting software for your real estate investment business will depend on your specific needs, budget, and growth plans. Consider the pricing structures, features, and support offered by different software providers to make an informed decision that aligns with your requirements.

Credit: www.avail.co

Top Software Picks For Real Estate Investors

When it comes to managing finances, real estate investors need accounting software that is efficient, user-friendly, and tailored to their specific needs. In this article, we will explore two top software picks for real estate investors: QuickBooks for Real Estate and Xero’s Real Estate Solutions.

Quickbooks For Real Estate

QuickBooks is a popular choice among real estate investors for its comprehensive features and ease of use. With QuickBooks Online, investors can track income and expenses, manage invoices, and generate financial reports with just a few clicks. QuickBooks also offers industry-specific versions, such as QuickBooks for Real Estate, which includes features specifically designed for property management, rental tracking, and tenant management.

One of the main advantages of using QuickBooks for Real Estate is its ability to integrate with other software and platforms commonly used by real estate professionals. From property management software to real estate CRM systems, QuickBooks seamlessly syncs data, saving investors time and reducing the risk of errors.

Furthermore, QuickBooks provides advanced reporting capabilities that enable investors to gain valuable insights into their real estate business. From analyzing property performance to monitoring rental income and expenses, QuickBooks offers a range of customizable reports that help investors make informed financial decisions.

Xero’s Real Estate Solutions

Xero is another top accounting software option for real estate investors. With its user-friendly interface and robust features, Xero’s Real Estate Solutions simplify financial management for investors in the real estate industry.

Similar to QuickBooks, Xero offers a range of features tailored specifically to real estate investors. From tracking rental income and expenses to managing property portfolios, Xero provides real-time visibility into the financial health of your real estate investments.

One notable feature of Xero is its seamless integration with various third-party apps and platforms. Investors can connect Xero with property management software, payment processors, and bank accounts, streamlining their financial workflows and eliminating the need for manual data entry.

Xero also offers a mobile app, allowing investors to manage their finances on the go. With real-time access to financial data, investors can stay informed and make quick decisions while out in the field.

When it comes to accounting software for real estate investors, both QuickBooks for Real Estate and Xero’s Real Estate Solutions offer robust features and user-friendly interfaces. Whether you choose QuickBooks or Xero, you can streamline your financial management processes and gain valuable insights into the performance of your real estate investments.

Making The Right Choice

When it comes to managing finances, real estate investors need accounting software that is tailored to their specific needs. Making the right choice can significantly impact the efficiency and profitability of their business. Here’s how real estate investors can ensure they are selecting the best accounting software for their needs.

Assessing Business Needs

Before diving into the array of accounting software options available, it’s crucial for real estate investors to assess their business needs. This involves identifying the specific accounting requirements unique to the real estate industry. From managing rental income and expenses to tracking property depreciation, real estate investors must consider software that offers features such as robust reporting, integration with property management systems, and support for multiple entities.

Taking Advantage Of Demos

One of the most effective ways to evaluate accounting software is by taking advantage of free demos offered by various providers. These demos allow real estate investors to get a firsthand experience of the software’s interface, functionality, and user-friendliness. During the demo, it’s essential to focus on how well the software aligns with the specific needs of the real estate business. Pay attention to features such as automated rent collection, expense tracking, and tax preparation capabilities.

Credit: softledger.com

Frequently Asked Questions

Is Quickbooks Good For Realtors?

Yes, QuickBooks is a good option for realtors. It helps in tracking finances, creating realistic goals, and setting quarterly milestones. QuickBooks is a reliable tool that can assist real estate businesses in creating a predictable and sustainable business model.

What Software Do Realtors Use?

Realtors commonly use software like NetSuite, Zoho, Northspyre, Lucernex, Yardi Breeze, and QuickBooks. These tools help with accounting, managing client interactions, automating workflows, and enhancing communication. QuickBooks is particularly popular for tracking finances and setting realistic goals in the real estate industry.

What Are The Key Features To Look For In Accounting Software For Real Estate Investors?

When choosing accounting software for real estate, look for features like property management, tenant tracking, rent collection, expense tracking, and financial reporting to ensure efficient management of real estate finances.

How Can Accounting Software Benefit Real Estate Investors?

Accounting software can streamline financial management, automate rent collection, track expenses, generate financial reports, and provide insights into the performance of real estate investments, ultimately saving time and improving decision-making.

Conclusion

After researching and analyzing the top accounting software options for real estate investors, it’s clear that each platform has unique strengths and weaknesses. However, QuickBooks Online stands out as a reliable and comprehensive solution for managing finances, tracking expenses, and generating reports.

With various pricing plans and customizable features, QuickBooks is a great option for both small and large real estate businesses. Whether you’re a seasoned investor or just starting out, using the right accounting software can make a significant difference in your financial success.

Leave a Reply