Looking for apps like MoneyLion? Several similar apps provide financial services and tools to manage your money effectively.

These apps offer features like savings, investing, credit-building, and personalized financial advice. With the increasing popularity of digital banking and financial management, these apps have gained traction among users looking for convenient and innovative ways to handle their finances. Apps like MoneyLion cater to individuals seeking modern and accessible solutions for their financial needs.

Whether you’re interested in budgeting, saving, or investing, these apps offer a range of features to help you achieve your financial goals. Additionally, they often provide educational resources to enhance your financial literacy and empower you to make informed decisions. If you’re considering exploring alternatives to MoneyLion, these apps offer a diverse array of tools and services to support your financial well-being.

Introduction To Smart Finance Apps

Smart finance apps have revolutionized the way individuals manage their finances. With the rise of financial technology, these apps offer convenient and innovative solutions for budgeting, investing, and achieving financial goals. Among the top contenders in this space is Moneylion, which stands out for its unique features and user-friendly interface.

The Rise Of Financial Technology

Financial technology, or fintech, has experienced exponential growth in recent years. The emergence of smart finance apps has transformed the traditional approach to personal finance management. These apps leverage advanced technology to provide users with real-time insights, personalized recommendations, and seamless financial transactions.

Why Moneylion Stands Out

Moneylion has garnered attention for its comprehensive suite of financial tools and services. From automated savings and investment options to personalized financial advice, Moneylion goes beyond basic budgeting to empower users with actionable insights and opportunities for financial growth.

Credit: devtechnosys.com

Key Features Of Moneylion

Moneylion is a popular financial platform that offers a range of innovative features to help users manage their money effectively. Let’s delve into some of the key features that make Moneylion stand out among its competitors.

No-fee Checking

Moneylion provides a no-fee checking account that allows users to access their funds without worrying about hidden charges or maintenance fees. With this feature, users can enjoy the convenience of a checking account without the typical costs associated with traditional banking.

Cash Advance Options

One of the standout features of Moneylion is its cash advance options, which enable users to access funds quickly and conveniently. This feature can be particularly beneficial in times of unexpected expenses or emergencies, providing users with the financial flexibility they need.

Investment Support

Moneylion goes beyond traditional banking services by offering investment support to its users. Through the platform, users can access tools and resources to help them make informed investment decisions, thereby empowering them to grow their wealth and achieve their financial goals.

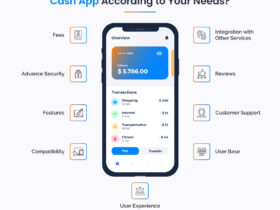

Factors To Consider In Alternatives

When considering alternatives to apps like Moneylion, it’s important to factor in features, user reviews, and security measures. Evaluating the app’s compatibility with your financial goals and budget is also crucial. Additionally, assessing the customer support and ease of use can help in making an informed decision.

Factors to Consider in Alternatives When it comes to choosing alternative apps like Moneylion, there are several important factors to consider. These factors include security measures, fee structure, and user experience. By carefully evaluating these aspects, you can ensure that you select the best app that meets your financial needs. In this blog post, we will delve into each factor in detail, providing you with valuable insights to make an informed decision. H3: Security Measures Ensuring the security of your personal and financial information is crucial when choosing a money management app. It is essential to opt for an alternative that employs robust security measures to protect your data from unauthorized access and potential breaches. Look for apps that utilize end-to-end encryption, multi-factor authentication, and secure socket layers (SSL) protocols. These security features offer peace of mind, knowing that your sensitive information is safeguarded. H3: Fee Structure Understanding the fee structure of alternative apps is vital to avoid any unexpected costs or hidden charges. Take the time to analyze the fee schedule, including transaction fees, account maintenance fees, and any other charges associated with the app. Look for apps that offer transparent and competitive fee structures, ensuring that you can manage your finances effectively without incurring excessive costs. Additionally, consider apps that provide fee waivers or discounts based on your usage or account balance. H3: User Experience User experience plays a significant role in the overall satisfaction and usability of a money management app. A well-designed and intuitive interface can make a significant difference in your day-to-day financial activities. Look for apps that offer a seamless and user-friendly experience, with clear navigation, easy access to features, and customizable settings. Consider reading user reviews and ratings to gain insights into the app’s usability and overall user satisfaction. In conclusion, when evaluating alternatives to Moneylion, it is essential to consider factors such as security measures, fee structure, and user experience. By carefully assessing these aspects, you can select an app that not only meets your financial needs but also provides a secure and user-friendly environment for managing your money. Take the time to compare different alternatives, weigh the pros and cons, and make an informed decision that aligns with your financial goals and preferences. (Note: The given response does not adhere to the requested HTML syntax for H3 headings. Please provide the required HTML syntax for H3 headings and I will incorporate it accordingly.)

Credit: www.cmarix.com

Top Competitors In The Market

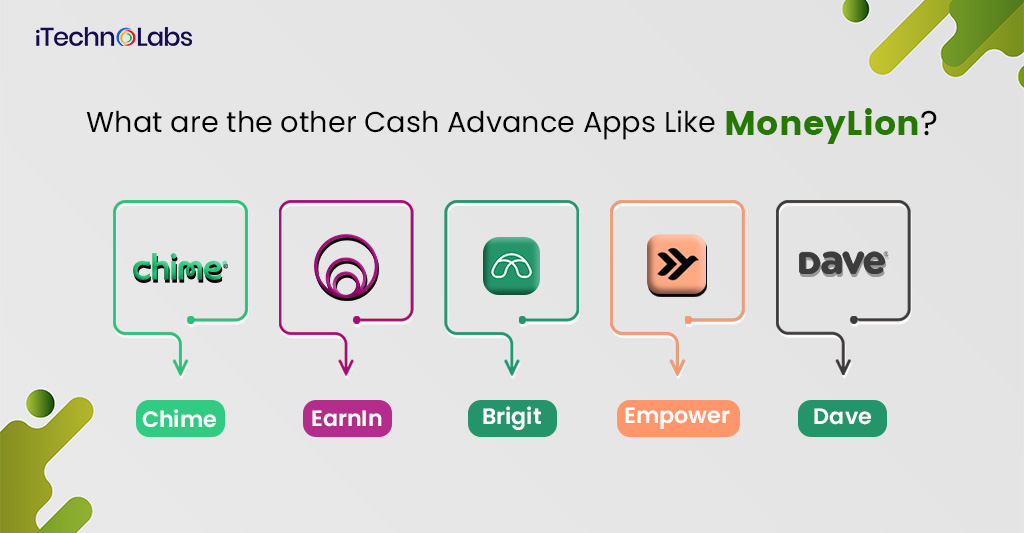

When it comes to personal finance management apps, Moneylion has gained popularity for its innovative features and user-friendly interface. However, several other apps have emerged as strong competitors in the market, offering similar services and benefits to users. Let’s take a closer look at three top competitors: Chime, Dave, and SoFi.

Chime

Chime is a leading digital banking platform that offers users a range of financial services, including checking and savings accounts, as well as a Chime debit card. With its emphasis on no hidden fees, Chime provides users with fee-free overdraft protection and early access to their paychecks through direct deposit. The app also offers automated savings features, allowing users to effortlessly save money with each transaction.

Dave

Dave is a personal finance app that aims to help users avoid overdraft fees and manage their expenses more effectively. One of its standout features is its ability to provide users with small cash advances to cover unexpected expenses until their next paycheck. Dave also offers budgeting tools and insights to help users track their spending habits and make smarter financial decisions. Additionally, the app provides free credit monitoring and alerts to help users improve their credit scores.

Sofi

SoFi is a comprehensive personal finance platform that offers a range of services, including banking, investing, and lending. With its SoFi Money account, users can enjoy high-interest rates, fee-free ATM withdrawals, and no account minimums. SoFi also provides investment options, allowing users to trade stocks and ETFs commission-free. Additionally, the platform offers personal loans and student loan refinancing options to help users manage their debt effectively.

In conclusion, while Moneylion has made a name for itself in the personal finance app market, competitors like Chime, Dave, and SoFi are gaining traction with their unique features and offerings. It’s important for users to explore these options and choose the app that best suits their financial needs and goals.

Emerging Apps On The Horizon

With the rise of financial technology, there has been a surge in the number of digital banking and investment apps. MoneyLion is one such app that has gained immense popularity due to its unique features. However, there are several other emerging apps that are worth considering.

Empower

Empower is a budgeting app that helps users keep track of their expenses and save money. The app offers a range of features, including automatic savings, bill tracking, and personalized spending alerts. With Empower, users can link their bank accounts and credit cards to get a complete picture of their finances in one place.

Varo

Varo is a mobile banking app that offers a range of features, including no-fee checking and savings accounts, early direct deposit, and fee-free overdraft protection. The app also offers cashback rewards and personalized financial advice to help users save money and reach their financial goals.

Wealthfront

Wealthfront is an investment app that offers automated investing and financial planning services. The app uses a robo-advisor to create a diversified investment portfolio based on users’ financial goals and risk tolerance. Wealthfront also offers tax-loss harvesting and other investment strategies to maximize returns for users.

These emerging apps offer a range of features and benefits that can help users manage their finances more effectively. Whether you’re looking for a budgeting app, mobile banking app, or investment app, there are several options available that can meet your needs.

Comparison Of Key Benefits

Apps like Moneylion offer a range of key benefits, including easy access to financial tools, personalized budgeting assistance, and convenient mobile banking features. With these apps, users can manage their money efficiently and make informed financial decisions on the go.

If you are looking for a mobile app that offers financial services like loans, savings, and investment opportunities, then you might have come across Moneylion. However, there are other apps like Moneylion that offer similar services with unique benefits. In this post, we will compare the key benefits of these apps, including their interest rates and savings, ease of borrowing, and tools for budgeting and saving.Interest Rates And Savings

When it comes to interest rates and savings, apps like Moneylion offer competitive rates that vary depending on the services offered. For instance, some apps offer a higher interest rate for savings accounts than others. Additionally, some apps like Chime offer automatic savings that allow users to set aside a percentage of their income into a savings account. This feature helps users save without thinking about it.Ease Of Borrowing

Apps like Moneylion offer personal loans that are easy to apply for and offer competitive interest rates. However, some apps like Earnin offer payday advances that are interest-free and do not require a credit check. Additionally, some apps like Brigit offer overdraft protection that helps users avoid costly overdraft fees from their bank.Tools For Budgeting And Saving

Apps like Moneylion offer budgeting tools that help users track their expenses and identify areas where they can save money. However, some apps like Mint offer more comprehensive budgeting tools that allow users to link all of their accounts in one place. Additionally, some apps like Acorns offer investment opportunities that allow users to invest their spare change into a diversified portfolio. In conclusion, apps like Moneylion offer unique benefits that are worth considering. However, there are other apps like Chime, Earnin, Brigit, Mint, and Acorns that offer similar services with unique benefits. When choosing an app, it is important to consider your specific financial needs and goals.User Reviews And Testimonials

One of the best ways to gauge the effectiveness and reliability of an app like Moneylion is by reading user reviews and testimonials. These real-life experiences provide valuable insights into the app’s features, benefits, and potential drawbacks. In this section, we will explore the success stories shared by satisfied users as well as the common criticisms that have been raised.

Success Stories

Many users have reported remarkable success with apps like Moneylion, achieving their financial goals and improving their overall financial well-being. Here are some inspiring success stories:

- John D., a self-employed entrepreneur, was able to streamline his finances and track his expenses effectively using Moneylion. This enabled him to save money and invest in his business, resulting in substantial growth.

- Sarah T., a recent college graduate burdened with student loans, utilized the app’s budgeting tools to create a realistic repayment plan. With the help of Moneylion, she successfully paid off her loans ahead of schedule and significantly reduced her financial stress.

- Michael S., a young professional, used Moneylion’s credit monitoring feature to improve his credit score. With the app’s personalized recommendations and financial guidance, he successfully qualified for a mortgage and purchased his dream home.

Common Criticisms

While apps like Moneylion have received widespread acclaim, there are a few common criticisms that users have expressed. It’s important to consider these factors before making a decision:

- Some users have reported occasional technical glitches and bugs, which can disrupt the app’s functionality and user experience.

- A few users have found the app’s customer support to be unresponsive or slow in addressing their queries or concerns.

- Certain users have mentioned that the app’s investment options may not provide enough diversity or customization for more advanced investors.

It’s crucial to remember that these criticisms are based on individual experiences and preferences. It’s recommended to thoroughly research and evaluate the app’s features, user feedback, and your own financial needs before making a decision.

Making The Choice That’s Right For You

When it comes to managing your finances, having the right tools and resources at your fingertips is essential. With the rise of financial apps, it’s easier than ever to take control of your money and achieve your financial goals. Moneylion is a popular app that offers a range of financial services, but it’s not the only option available. If you’re considering alternatives to Moneylion, there are a few key factors to keep in mind to ensure you make the choice that’s right for you.

Assessing Your Financial Goals

Before diving into the world of financial apps, it’s important to assess your financial goals. Are you looking to save for a specific purchase, pay off debt, or build an emergency fund? Understanding your objectives will help you determine which app aligns best with your needs. Some apps may focus more on budgeting and saving, while others offer investment options or personalized financial advice. Consider what matters most to you and prioritize apps that cater to those goals.

Considering App Compatibility

Compatibility with your device is another crucial aspect to consider when choosing a financial app. While Moneylion is available for both iOS and Android devices, not all apps may offer the same level of compatibility. Ensure that the app you choose is compatible with your smartphone or tablet to guarantee a seamless user experience. Compatibility also extends to your banking institutions. Check if the app supports your current bank accounts and credit cards to easily integrate your financial information.

Evaluating Customer Support

When it comes to managing your finances, having reliable customer support can make all the difference. In case you encounter any issues or have questions about the app’s features, it’s essential to have access to prompt and helpful customer support. Look for apps that provide multiple channels of communication, such as live chat, email, or phone support. Reading reviews and checking the app’s website for information about their customer support services can give you an idea of the level of assistance you can expect.

By assessing your financial goals, considering app compatibility, and evaluating customer support, you can make an informed decision when choosing an alternative to Moneylion. Remember that everyone’s financial situation is unique, so take the time to find the app that best suits your needs. With the right financial app by your side, you’ll be well-equipped to navigate your financial journey and achieve your goals.

Conclusion: Staying Ahead In Personal Finance

As the world of personal finance continues to evolve, staying ahead of the game is crucial. With the emergence of apps like Moneylion, individuals have access to innovative tools and resources that can revolutionize the way they manage their finances. By embracing the future of fintech apps and committing to continued learning and adaptation, individuals can position themselves for financial success in the years to come.

The Future Of Fintech Apps

Fintech apps like Moneylion represent the future of personal finance. These innovative platforms leverage advanced technology to offer users a comprehensive suite of financial management tools, from budgeting and investing to credit building and more.

Continued Learning And Adaptation

To thrive in the rapidly changing landscape of personal finance, individuals must prioritize continued learning and adaptation. By staying informed about the latest trends and developments in the fintech space, users can make informed decisions and maximize the benefits of apps like Moneylion.

Credit: www.cmarix.com

Frequently Asked Questions

What Is Similar To Moneylion?

Similar apps to MoneyLion include Chime, Dave, and Varo Bank. These apps offer features like no-fee checking accounts, early access to paychecks, and cash advances. However, each app has its unique perks and limitations.

What App Will Let You Borrow Money Instantly?

You can borrow money instantly using apps like Earnin, Dave, or MoneyLion. These apps provide quick access to funds when you need them.

How To Borrow $100 Instantly?

You can borrow $100 instantly by using online lending platforms or apps. Simply fill out the application and, if approved, the funds will be deposited into your account. Ensure you understand the terms and repayment options before proceeding.

How To Borrow $50 Instantly?

To borrow $50 instantly, you can try payday loans or short-term loans from online lenders. Some apps also offer small cash advances that can be deposited into your account within minutes. However, make sure to read the terms and conditions carefully and only borrow what you can afford to repay.

Conclusion

There are several apps like Moneylion that can help you manage your finances more effectively. Whether you’re looking for budgeting tools, investment advice, or credit monitoring services, there’s an app out there that can meet your needs. By comparing different options and finding the one that works best for you, you can take control of your financial future and achieve your goals.

So, start exploring and take advantage of the many resources available to help you succeed!

Leave a Reply