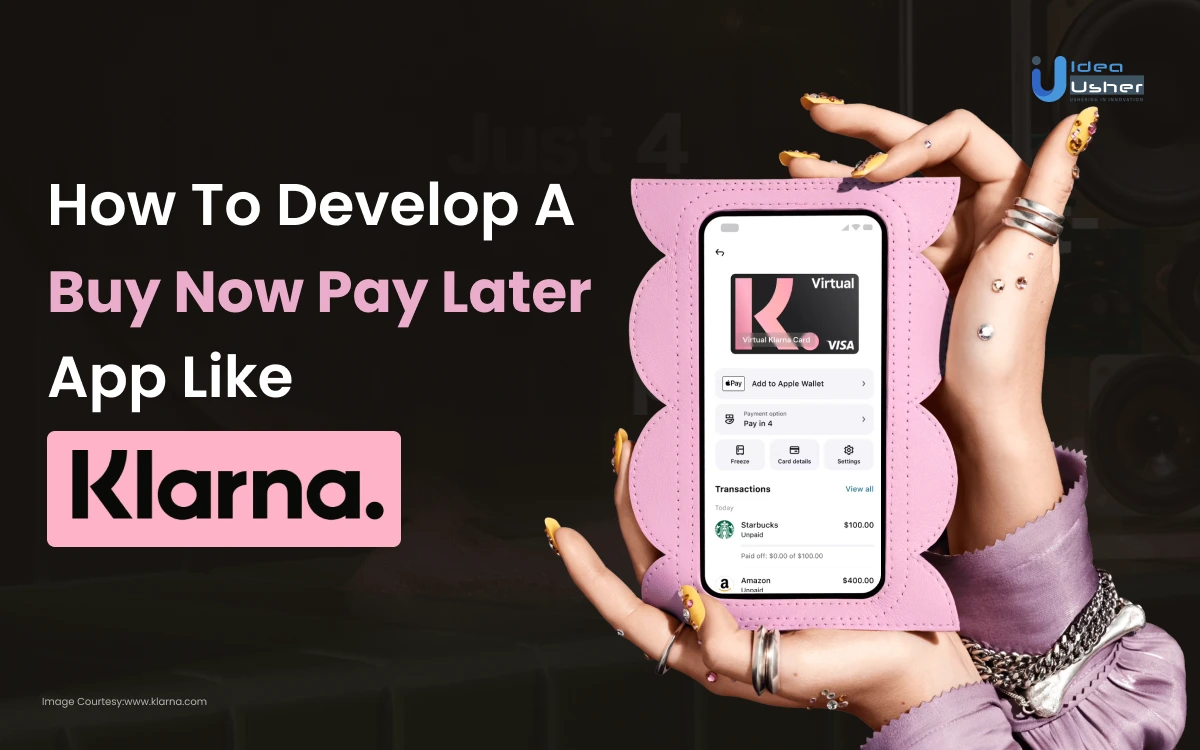

Apps like Klarna include Afterpay, Affirm, and Sezzle, offering similar buy now, pay later services. These apps provide the convenience of splitting purchases into manageable installments, making them popular among shoppers.

With the rising trend of deferred payment options, more consumers are turning to these alternatives for flexible and interest-free payment solutions. In today’s fast-paced and evolving retail landscape, the demand for convenient and flexible payment options has soared. Apps like Klarna have gained popularity for their ability to offer consumers the flexibility to split their purchases into manageable installments.

As the buy now, pay later trend continues to grow, several alternatives such as Afterpay, Affirm, and Sezzle have emerged, catering to the increasing consumer preference for deferred payment solutions. These apps provide a seamless and transparent way for shoppers to make purchases and manage their finances.

Credit: ideausher.com

The Rise Of Buy Now, Pay Later Services

The Rise of Buy Now, Pay Later Services has revolutionized the way people shop and pay for their purchases. With the increasing popularity of apps like Klarna, consumers now have the flexibility to make purchases and pay for them in installments, rather than upfront. This shift in consumer behavior has led to a market explosion and changing preferences in the way people approach retail transactions.

Market Explosion

The emergence of Buy Now, Pay Later (BNPL) services has led to a significant market explosion in the retail industry. Consumers are drawn to the convenience and flexibility offered by these payment solutions, which allow them to split their payments into manageable installments. As a result, retailers are witnessing a surge in sales and conversion rates, as more customers are inclined to make purchases when they have the option to pay later.

Changing Consumer Preferences

The rise of BNPL services has prompted a shift in consumer preferences and purchasing behavior. Traditional payment methods are being overshadowed by the allure of deferred payments and interest-free installment plans. Consumers are increasingly gravitating towards the convenience and financial freedom offered by these services, as it aligns with their desire for more control over their finances and spending.

Key Features Of Klarna

Klarna is a popular buy now, pay later app that offers a range of convenient and flexible payment options for online shoppers. Let’s explore the key features of Klarna that have made it a preferred choice for many users.

Flexible Payment Options

Klarna provides users with various payment options to suit their preferences and financial situations. It allows customers to split their purchases into installments, making it easier to manage larger expenses. Additionally, Klarna offers interest-free financing for a set period, giving users the flexibility to pay over time without incurring extra charges.

User-friendly Interface

One of the standout features of Klarna is its intuitive and user-friendly interface. The app’s design and layout make it easy for users to navigate through the platform, browse products, and complete purchases seamlessly. With clear payment information and transparent terms, Klarna ensures that users can make informed decisions without any confusion.

Top Klarna Competitors

When it comes to flexible payment options, Klarna has established itself as a popular choice among consumers. However, there are several other apps like Klarna that offer similar services. In this article, we will explore some of the top Klarna competitors that you should consider.

Afterpay

Afterpay is a leading buy now, pay later platform that allows shoppers to split their purchases into four equal payments, with no interest or fees if paid on time. With Afterpay, customers can enjoy instant approval and have the flexibility to pay over time without the need for a credit check.

Affirm

Affirm offers a transparent and flexible financing option for online purchases. With Affirm, customers can choose to pay for their purchases in fixed monthly installments over a specified period. The platform provides real-time financing decisions, allowing customers to make informed choices and budget their payments accordingly.

Paypal Credit

PayPal Credit, formerly known as Bill Me Later, is a digital credit line provided by PayPal. Customers can use PayPal Credit to make purchases online and enjoy promotional financing offers such as no interest if paid in full within a certain period. This convenient payment option allows customers to manage their payments through their PayPal account.

Comparison Table

| App | Payment Option | Interest or Fees | Approval Process |

|---|---|---|---|

| Afterpay | Split payments into four installments | No interest or fees if paid on time | Instant approval |

| Affirm | Fixed monthly installments | Varies based on purchase and creditworthiness | Real-time financing decisions |

| PayPal Credit | Pay over time with promotional financing offers | No interest if paid in full within promotional period | Approval through PayPal account |

These are just a few examples of the top Klarna competitors. Each platform offers its own unique features and benefits, so it’s important to consider your specific needs and preferences when choosing the right payment option for you.

Interest-free Alternatives

Discover interest-free alternatives to Klarna with these innovative apps. Say goodbye to high interest rates and hello to flexible payment options that won’t break the bank. Shop smarter and save more with these convenient alternatives.

Interest-Free Alternatives If you’re looking for interest-free alternatives to Klarna, there are a few options available that can provide you with the flexibility and convenience you need. These alternatives offer a seamless shopping experience with the added benefit of spreading your payments over time without any interest charges. Let’s explore some popular interest-free alternatives that can help you manage your finances responsibly. Splitit Splitit is a fantastic interest-free alternative that allows you to split your purchases into manageable monthly payments. With Splitit, you don’t have to worry about interest charges or fees. The process is simple – you can choose Splitit as your payment option at checkout, and the purchase amount will be divided into equal installments. You can use your existing credit card and enjoy the flexibility of paying over time without any additional costs. Splitit is widely accepted by various online retailers, making it a convenient choice for your shopping needs. Sezzle Sezzle is another excellent interest-free alternative that allows you to split your purchases into four equal installments. This buy now, pay later platform is gaining popularity due to its simplicity and convenience. With Sezzle, you can shop at your favorite stores and pay for your purchases over time, without any interest charges or fees. The approval process is quick and easy, and you can start using Sezzle right away. Simply select Sezzle as your payment option at checkout and enjoy the freedom of interest-free shopping. In conclusion, if you’re looking for interest-free alternatives to Klarna, Splitit and Sezzle are two great options to consider. These platforms offer a seamless shopping experience and allow you to spread your payments over time without any interest charges or fees. With Splitit and Sezzle, you can manage your finances responsibly while enjoying the flexibility of interest-free shopping.Mobile Wallet Integrations

Mobile wallet integrations are becoming increasingly important for apps like Klarna. By allowing users to store payment information securely and easily, these integrations streamline the checkout process and improve the overall user experience.

Mobile Wallet Integrations are becoming increasingly popular as consumers are seeking a more convenient and secure way to pay for their purchases. Klarna is one of the leading mobile payment providers, but there are other apps like Klarna that also offer this feature. In this section, we will look at two of the most popular mobile wallet integrations available today: Apple Pay and Google Pay.Apple Pay

Apple Pay is a digital wallet service that allows users to make payments with their iPhone, Apple Watch, or iPad. It uses Near Field Communication (NFC) technology to securely transmit payment information between the device and the merchant’s payment terminal. To use Apple Pay, users simply need to add their credit or debit card to their Wallet app and authenticate their identity with Touch ID or Face ID. One of the benefits of using Apple Pay is that it is incredibly secure. Each transaction is authorized with a one-time unique dynamic security code, which means that the user’s card details are never stored on the device or shared with the merchant. Additionally, Apple Pay is widely accepted at many retailers worldwide, making it a convenient option for users.Google Pay

Google Pay is another popular mobile wallet integration that allows users to make payments with their Android device. It uses a combination of NFC technology and a virtual account number to securely transmit payment information to the merchant. To use Google Pay, users need to add their credit or debit card to the app and authenticate their identity with a PIN, password, or biometric data. One of the benefits of using Google Pay is that it is accepted at millions of locations worldwide, including online stores and in-app purchases. Additionally, Google Pay offers users the ability to store loyalty cards, gift cards, and other payment methods in one convenient location. In conclusion, mobile wallet integrations like Apple Pay and Google Pay are revolutionizing the way we pay for our purchases. By offering a more secure and convenient payment method, these apps like Klarna are becoming increasingly popular with consumers. Whether you prefer Apple Pay or Google Pay, there are plenty of options available to help simplify your payment process.Exclusive In-app Deals

The rise of buy now pay later options like Klarna has revolutionized the way we shop. With exclusive in-app deals, users can save big on their purchases and take advantage of discounts that aren’t available anywhere else. Here are some other apps like Klarna that offer exclusive in-app deals:

Honey

Honey is a popular browser extension that helps users find the best deals and discounts online. In addition to its browser extension, Honey also has an app that offers exclusive in-app deals to users. With Honey, users can earn cashback on their purchases and access exclusive coupons that aren’t available anywhere else.

Shopkick

Shopkick is a rewards app that offers users exclusive in-app deals and discounts. With Shopkick, users can earn rewards points, or “kicks,” for shopping at their favorite stores. These kicks can then be redeemed for gift cards or other rewards. Shopkick also offers exclusive deals and discounts to its users, making it a great alternative to Klarna for those looking to save money on their purchases.

Global Reach Of Payment Apps

Payment apps have revolutionized the way we make transactions, providing a convenient and secure method for individuals and businesses worldwide. With their global reach, payment apps like Klarna have made it easier than ever to shop online and manage finances. However, Klarna is not the only player in the game. There are several other payment apps that offer similar features, such as Revolut and Curve.

Revolut

Revolut is a payment app that has gained significant popularity due to its extensive global reach. It allows users to send and receive money internationally with competitive exchange rates, making it ideal for travelers or individuals with international connections. With its user-friendly interface and innovative features, Revolut has become a go-to payment app for many.

Curve

Curve is another payment app that offers a unique twist to the traditional payment experience. It allows users to link multiple debit and credit cards to a single Curve card, making it a convenient solution for those who carry multiple cards. Additionally, Curve offers competitive foreign exchange rates and cashback rewards, making it an attractive choice for frequent travelers.

Both Revolut and Curve, like Klarna, have expanded their services globally, catering to customers from various countries. Their user-friendly interfaces and innovative features have made them popular alternatives to traditional payment methods.

In conclusion, the global reach of payment apps like Klarna, Revolut, and Curve has transformed the way we handle transactions. These apps provide a seamless and secure experience, allowing users to manage their finances effortlessly, whether they are at home or traveling abroad.

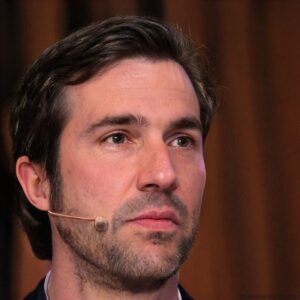

Credit: solguruz.com

Evaluating Security Measures

When it comes to using apps like Klarna, one of the most important factors to consider is the security of your personal and financial information. With the increasing prevalence of online fraud and data breaches, it is crucial to choose an app that prioritizes your safety. In this section, we will explore the security measures implemented by these apps, focusing on data protection and fraud prevention.

Data Protection

Protecting your data is of utmost importance when using any financial app. Apps like Klarna employ robust security measures to ensure the confidentiality and integrity of your information. They utilize encryption protocols to safeguard your personal and financial data, making it unreadable to unauthorized individuals.

Additionally, these apps implement strict access controls, limiting access to your data to authorized personnel only. They also regularly update their security systems and conduct audits to identify and address any vulnerabilities.

Fraud Prevention

Fraud prevention is another crucial aspect of app security. Apps like Klarna employ advanced fraud detection systems that analyze various parameters to identify and prevent fraudulent activities. These systems use machine learning algorithms to detect patterns and anomalies, allowing them to flag and block suspicious transactions.

Moreover, these apps provide additional security measures such as two-factor authentication, which adds an extra layer of protection to your account. This ensures that even if your login credentials are compromised, unauthorized individuals cannot access your account without the second authentication factor.

In addition to these measures, apps like Klarna have dedicated teams that continuously monitor and investigate any suspicious activities. They work closely with financial institutions and law enforcement agencies to combat fraud and ensure the security of their users’ transactions.

Overall, when evaluating apps like Klarna, it is crucial to consider their security measures. By prioritizing data protection and fraud prevention, these apps provide users with a secure and reliable platform for their financial transactions.

User Reviews And Ratings

Consumer Feedback

Consumers have provided valuable insights into their experiences with apps like Klarna. Many users have praised the seamless user interface and the convenience of managing their payments and purchases in one place. The flexibility in payment options has been a highlight for numerous users, allowing them to budget and plan their expenses effectively. Additionally, the straightforward installment plans have garnered positive feedback, making it easier for users to afford larger purchases without straining their finances.

Expert Analysis

Expert evaluations have emphasized the impact of user-friendly interfaces and smooth payment processes on the overall appeal of apps similar to Klarna. The ability to split payments into manageable installments has been recognized as a significant factor in driving user satisfaction. Furthermore, the integration of transparent terms and conditions has contributed to building trust among consumers, enhancing the app’s reputation for reliability and customer-centric services.

Credit: www.matellio.com

Future Of Retail Payment Solutions

The future of retail payment solutions is rapidly evolving, driven by the increasing demand for seamless, convenient, and secure payment experiences. As technology continues to advance, consumers are looking for innovative payment options that offer flexibility and convenience. Apps like Klarna are at the forefront of this transformation, providing users with the ability to shop now and pay later, effectively reshaping the way people approach retail payments. In this blog post, we will explore the latest trends and innovative technologies shaping the future of retail payment solutions.

Trends To Watch

As the retail industry continues to embrace digital transformation, several key trends are emerging in the realm of payment solutions. Mobile payments have gained significant traction, allowing consumers to make purchases using their smartphones, while contactless payments have become increasingly popular due to their convenience and hygiene benefits.

Personalized payment options are also on the rise, with consumers seeking tailored payment plans that align with their financial preferences. Moreover, the integration of biometric authentication for secure and seamless transactions is a trend that is gaining momentum in the retail payment landscape.

Innovative Technologies

The future of retail payment solutions is being shaped by innovative technologies that are revolutionizing the way transactions are conducted. Blockchain technology is disrupting the traditional payment ecosystem by providing a decentralized and secure platform for conducting financial transactions.

Artificial intelligence and machine learning algorithms are being leveraged to analyze consumer behavior and preferences, enabling retailers to offer personalized payment experiences. Additionally, tokenization technology is enhancing the security of payment data, minimizing the risk of fraud and unauthorized access.

Frequently Asked Questions

Is There Another App Similar To Klarna?

Yes, there are similar apps to Klarna, such as Afterpay, Affirm, and Sezzle. These apps offer buy now, pay later options like Klarna.

Who Is Klarna’s Biggest Competitor?

Klarna’s biggest competitor is Afterpay. They both offer similar “buy now, pay later” services.

Which Buy Now, Pay Later App Doesn’t Check Credit?

There are some buy now, pay later apps that don’t check credit, such as Afterpay, Klarna, and Quadpay. However, it’s important to note that while they may not perform a traditional credit check, they may still use alternative methods to assess creditworthiness.

Is Klarna Or Afterpay Better?

Klarna and Afterpay are both popular buy now, pay later services. The better option depends on your preferences. Klarna offers more flexibility with multiple payment options and a wider range of participating retailers. Afterpay, on the other hand, has stricter payment schedules and a smaller network of merchants.

Choose based on your needs.

Conclusion

To sum it up, there are various apps like Klarna that provide flexible payment options and cater to the needs of the modern-day consumer. By using these apps, users can enjoy the convenience of hassle-free shopping and payment experiences. It’s crucial to choose an app that aligns with your preferences and offers the best features that suit your needs.

With the rise of e-commerce, it’s essential to stay up-to-date with the latest payment methods and technologies to make the most out of your shopping experience.

Leave a Reply