Apps like Dave include Brigit, MoneyLion, and Even, which offer similar features for managing finances. In today’s fast-paced world, many people find it challenging to keep up with their finances.

With the rise of the gig economy and irregular pay schedules, traditional budgeting methods may not always work. This is where apps like Dave come in. These apps provide a convenient way to access money before payday, avoid overdraft fees, and gain better control over personal finances.

In this blog, we’ll explore some popular alternatives to Dave, highlighting their features and benefits. Whether you’re looking to avoid overdraft fees, get a cash advance, or improve your financial literacy, these apps offer solutions to help you manage your money more effectively.

Introduction To Cash Advance Apps

Cash advance apps have become increasingly popular in recent years as a convenient solution for individuals facing unexpected financial challenges. These apps provide quick access to small amounts of money to help cover immediate expenses, with the repayment typically due on the next payday. One well-known option in this category is Dave, which offers users the ability to borrow up to $100 without the need for a credit check. However, there are various alternatives to Dave that also provide similar services, each with its own unique features and benefits.

The Rise Of Financial Apps

Financial apps have experienced a significant surge in popularity, offering users a range of convenient services to manage their money. Cash advance apps, in particular, have gained widespread attention due to their ability to provide quick funds to individuals in need. The rise of these apps reflects a growing demand for accessible and efficient financial solutions in today’s fast-paced world.

Why Consider Alternatives To Dave?

While Dave is a well-known and widely used cash advance app, exploring alternative options can offer users a broader selection of features and benefits. Considering alternatives to Dave can provide users with the opportunity to find an app that better suits their individual financial needs and preferences. Furthermore, exploring different apps can help users compare fees, interest rates, and repayment terms to ensure they are accessing the most suitable and cost-effective solution for their specific circumstances.

Credit: newsdirect.com

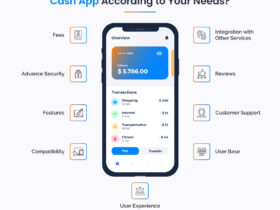

Key Features Of Cash Advance Apps

Cash advance apps like Dave offer a range of key features that can help users manage their finances more effectively. These apps provide convenient solutions for accessing funds, budgeting, and protecting against overdrafts. Understanding the key features of cash advance apps can help users make informed decisions about which app best suits their needs.

Early Paycheck Access

Cash advance apps like Dave allow users to access their paychecks before the scheduled payday. This feature provides financial flexibility and can be particularly beneficial for those facing unexpected expenses or cash flow challenges.

Budgeting Tools

These apps offer robust budgeting tools that enable users to track their spending, set financial goals, and create personalized budgets. The budgeting tools empower users to make informed financial decisions and manage their money more effectively.

Overdraft Protection

Cash advance apps provide overdraft protection, helping users avoid costly overdraft fees from their banks. This feature offers peace of mind and helps users maintain financial stability, especially during times of financial uncertainty.

Criteria For Choosing The Best App

When it comes to finding the best app like Dave, there are a few important criteria to consider. These factors can help you determine which app will best meet your needs and provide you with the financial support and convenience you’re looking for. Let’s take a closer look at three key criteria: interest rates and fees, ease of use, and customer support.

Interest Rates And Fees

One of the most crucial factors to consider when choosing an app like Dave is the interest rates and fees associated with borrowing money. You want to ensure that you’re getting a fair deal and not being charged exorbitant fees. Look for an app that offers competitive interest rates and transparent fee structures. By comparing different apps, you can find one that aligns with your budget and financial goals.

Ease Of Use

The app you choose should be easy to navigate and use, even for those who are not tech-savvy. Look for an app that has a user-friendly interface and intuitive design. It should provide clear instructions and make it simple to access your account, request funds, and manage your repayments. A seamless user experience can save you time and frustration, allowing you to focus on your financial goals.

Customer Support

Having reliable customer support is essential when using any financial app. Look for an app that offers various support channels, such as email, phone, or live chat. The app should provide prompt and helpful responses to any inquiries or issues you may have. Good customer support ensures that you have the assistance you need throughout your financial journey.

Top Dave Competitors For Quick Cash

When you need quick cash to cover unexpected expenses or make ends meet, there are several apps like Dave that can provide you with the financial assistance you need. These apps offer various features and benefits to help you access funds quickly and conveniently. In this article, we will explore two of the top Dave competitors for quick cash: Earnin and Brigit.

Earnin: Paycheck Advances With No Fees

Earnin is an app that allows you to access your paycheck before payday without any fees or interest charges. With Earnin, you can receive up to $500 per pay period based on the hours you’ve worked. The app connects to your bank account and tracks your work hours through your employer’s timesheet or GPS. Once you’ve accumulated earnings, you can request a payout, and the money will be deposited into your bank account within one to two business days.

Brigit: Financial Health In One App

Brigit is an all-in-one financial app that not only provides quick cash advances but also helps you manage your finances more effectively. With Brigit, you can access up to $250 instantly to cover unexpected expenses. The app also offers budgeting tools, automatic savings, and financial insights to help you improve your financial health. Brigit analyzes your spending patterns and provides personalized recommendations to help you save money and avoid overdraft fees. Additionally, the app offers a feature that automatically advances funds to your account if it detects a low balance, ensuring you never have to worry about overdrawing your account.

Both Earnin and Brigit are excellent alternatives to Dave when it comes to accessing quick cash. Whether you need a simple paycheck advance with no fees or a comprehensive financial app to improve your overall financial well-being, these apps have you covered. Explore these alternatives and choose the one that best suits your needs and preferences.

Comparing User Experiences

Apps like Dave have become increasingly popular in recent years, offering users an alternative to traditional banking services. With so many options available, it can be difficult to decide which app is right for you. One way to compare these apps is by looking at user experiences. In this post, we’ll explore the user experiences of some of the top apps like Dave.

App Interface And Navigation

The app interface and navigation are important factors to consider when comparing user experiences. Users want an app that is easy to navigate and use. Apps like Dave have a simple and intuitive interface, with easy-to-use features like budget tracking and bill reminders. Additionally, these apps often offer a variety of customization options, allowing users to personalize their experience. For example, some apps allow users to choose their own color scheme or add custom categories to their budget.

User Reviews And Ratings

User reviews and ratings are another important factor to consider when comparing user experiences. These reviews provide valuable insights into the app’s strengths and weaknesses. Apps like Dave have generally positive reviews, with users praising the app’s ease of use and helpful features. However, some users have reported issues with customer service or technical glitches. It’s important to read a variety of reviews before making a decision.

When comparing user experiences, it’s important to consider factors like app interface and navigation, as well as user reviews and ratings. Apps like Dave offer a variety of features and customization options that make them a popular choice for many users. However, it’s important to do your research and choose an app that best fits your needs and preferences.

Safety And Security

When it comes to managing our finances, there are many apps available in the market. Apps like Dave have gained popularity due to their user-friendly interface and easy access to short-term loans. However, safety and security are paramount when it comes to managing our financial information. Let’s take a closer look at the safety and security features of Apps Like Dave.

Encryption And Data Protection

One of the most significant concerns with financial apps is the protection of user data. Apps like Dave use encryption to protect users’ personal and financial data. Encryption is a process that converts user data into a code that cannot be read by unauthorized parties. Dave uses 256-bit encryption, which is considered to be highly secure and is used by many financial institutions.

The app also uses secure servers to store user data, which are monitored 24/7 to ensure that there are no breaches. Additionally, Dave has implemented multi-factor authentication to prevent unauthorized access to user accounts.

Regulatory Compliance

Apps like Dave need to comply with regulatory requirements to ensure that user data is safe. Dave is a licensed lender and is regulated by the Consumer Financial Protection Bureau (CFPB). The CFPB is responsible for enforcing federal consumer financial laws and ensuring that financial institutions comply with these laws.

Dave also complies with the Gramm-Leach-Bliley Act (GLBA), which requires financial institutions to protect user data and provide privacy notices to customers.

Apps like Dave have taken significant steps to ensure that user data is safe and secure. Encryption, secure servers, and regulatory compliance are all measures that Dave has implemented to protect user data. Before using any financial app, it’s important to research its safety and security features to ensure that your data is protected.

Limitations And Considerations

When it comes to financial apps, it’s important to be aware of the limitations and considerations before diving in. Apps like Dave offer convenient borrowing options, but it’s essential to understand the borrowing limits and eligibility requirements.

Borrowing Limits

Before using an app like Dave, it’s crucial to know the borrowing limits. These limits determine the maximum amount you can borrow at any given time. Dave, for example, offers borrowing limits up to $100. This can be helpful for small, short-term expenses, but it may not be suitable for larger financial needs.

Eligibility Requirements

While apps like Dave provide quick access to funds, it’s necessary to meet certain eligibility requirements. These requirements ensure that users are responsible borrowers and can repay the borrowed amount. Some common eligibility criteria for apps like Dave include:

- Being at least 18 years old

- Having a regular source of income

- Having a valid checking account

- Meeting the minimum income requirements

Meeting these requirements is essential to be eligible for borrowing through apps like Dave. It’s important to review and understand the specific criteria set by each app to ensure you meet the qualifications.

By understanding the borrowing limits and eligibility requirements of apps like Dave, you can make informed decisions about your financial needs. These considerations help you determine if such apps align with your requirements and if they provide the necessary support for your unique financial situation.

Credit: www.linkedin.com

Emerging Apps In The Market

As the demand for financial management tools continues to grow, a new wave of innovative apps is emerging in the market. These apps aim to provide users with convenient and efficient solutions to their financial needs. One such app that has gained popularity is Dave. However, there are also other apps like Dave that are making their mark with their unique features and potential for market disruption.

Innovative Features

Apps like Dave are known for their innovative features that set them apart from traditional banking apps. These apps utilize advanced technology to offer users a range of services that go beyond basic banking. Some of the innovative features found in these apps include:

- Early paycheck access: Users can get their paychecks deposited into their accounts before their actual payday, providing them with financial flexibility.

- Automatic budgeting: These apps analyze users’ spending patterns and provide personalized budgeting recommendations to help them manage their finances effectively.

- No-overdraft fee: Unlike traditional banks, these apps do not charge overdraft fees, helping users avoid unnecessary expenses.

- Financial education: Many of these apps offer educational resources and tools to help users improve their financial literacy and make informed decisions.

Potential For Market Disruption

Apps like Dave have the potential to disrupt the traditional banking industry and change the way people manage their finances. With their user-friendly interfaces and innovative features, these apps are attracting a younger demographic who are looking for more convenient and flexible financial solutions. By offering services that traditional banks may not provide, such as early paycheck access and no-overdraft fees, these apps are reshaping the way people interact with their money.

Furthermore, these emerging apps are challenging the notion that financial management is a complex and daunting task. By providing user-friendly tools and educational resources, they are empowering individuals to take control of their finances and make better financial decisions. This disruption in the market is forcing traditional banks to adapt and innovate in order to stay relevant in the digital age.

Credit: echoinnovateit.com

Frequently Asked Questions

What App Will Spot Me $100 Dollars Instantly?

You can get $100 instantly through the Earnin app. It allows you to access your earned wages before payday.

What Is Another App Like Dave?

An app similar to Dave is “Earnin,” which offers early access to earned wages.

What Is The Number 1 App To Borrow Money?

The top app for borrowing money is [App Name]. It is user-friendly, secure, and offers competitive interest rates. With a simple application process and quick approval, it provides fast access to funds. Whether for emergencies or personal expenses, [App Name] is the number one choice for borrowing money.

What App Will Give Me $200 Instantly?

There is no app that can give you $200 instantly. Any app claiming to do so is likely a scam. Be cautious of any offers that seem too good to be true and always do your research before sharing personal information or downloading any apps.

Conclusion

After researching and testing various financial apps like Dave, we have concluded that there are several great options available for those who need help managing their finances. Whether you need an app that helps you budget, save money, or borrow funds, there is an app out there that can meet your needs.

From the user-friendly interface of Mint to the low fees of Brigit, these apps can help you take control of your finances and achieve your financial goals. So, explore your options and find the app that works best for you.

Leave a Reply