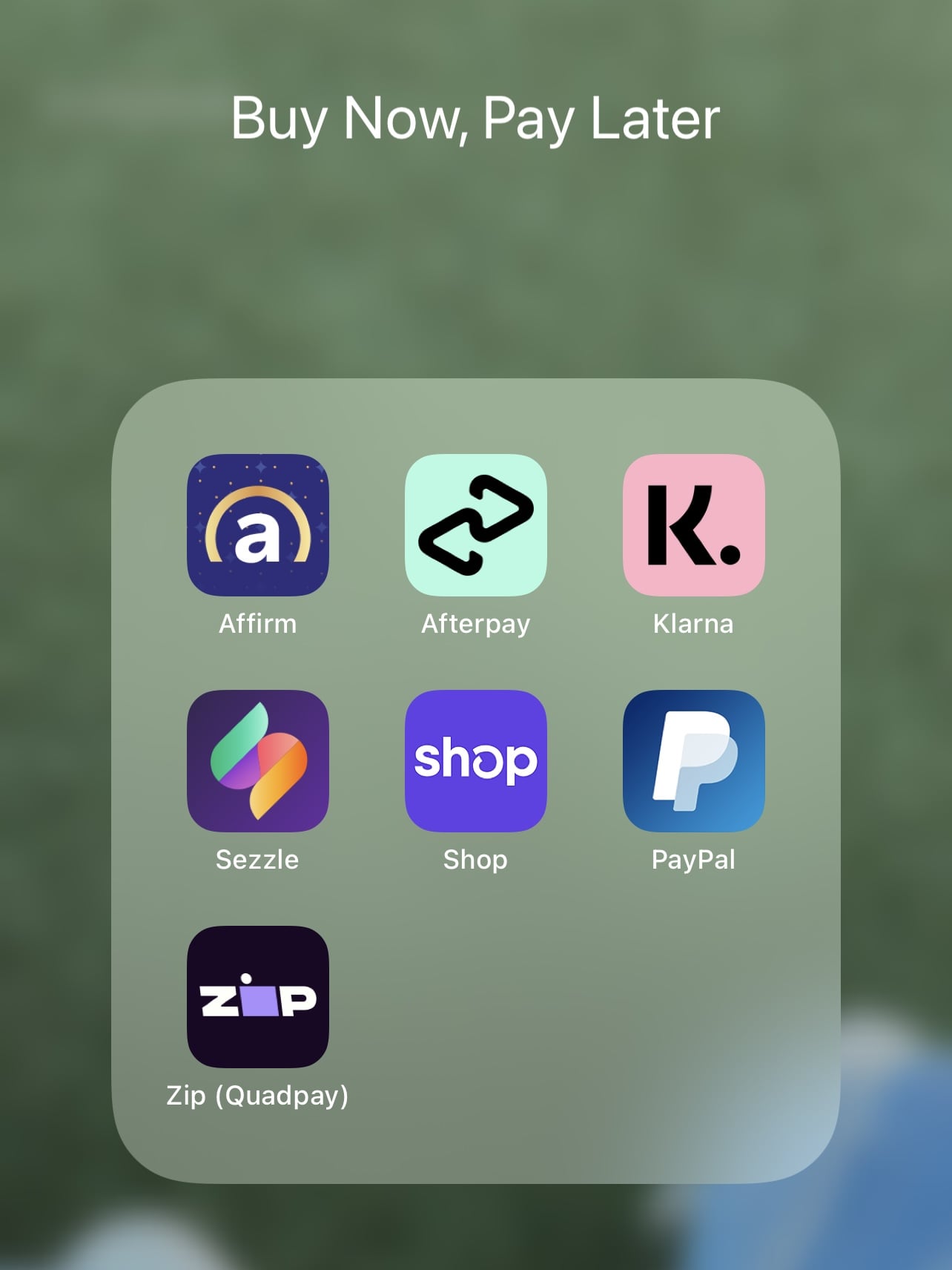

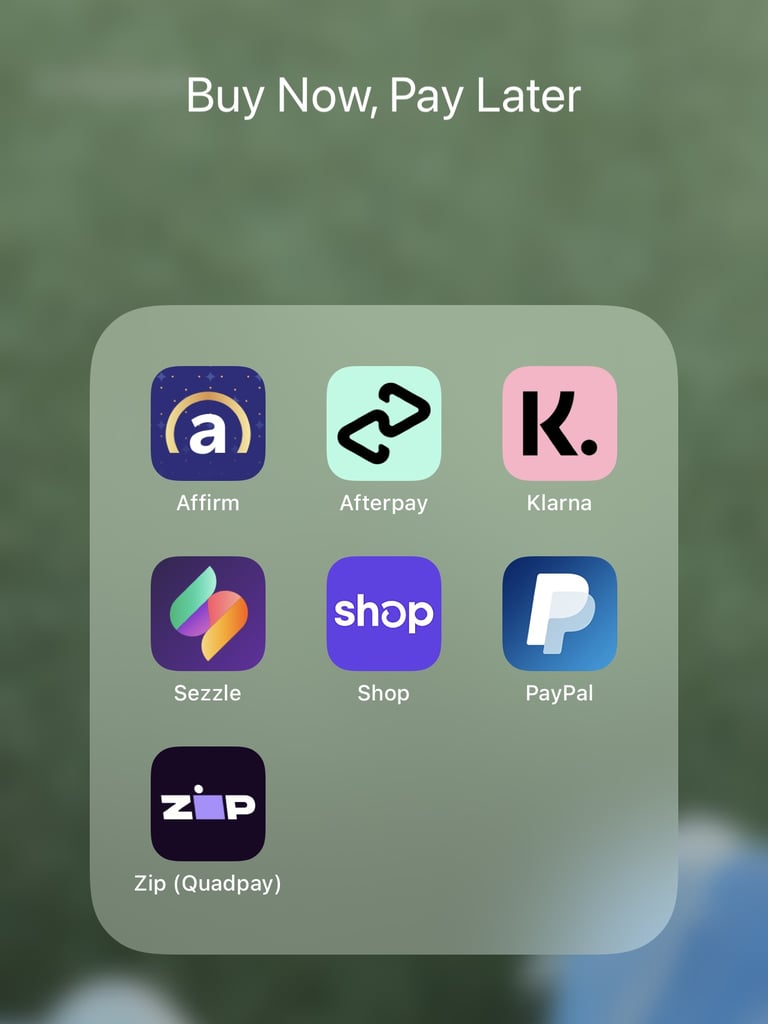

Apps like Afterpay include Klarna, Zip, Sezzle, and Quadpay, offering similar buy now, pay later services. In today’s fast-paced world, the convenience of buy now, pay later services has gained immense popularity among consumers.

Afterpay, a widely known platform, has paved the way for other similar apps to enter the market, providing customers with flexible payment options. We’ll explore some of the top alternatives to Afterpay, highlighting their features and benefits. Whether you’re a consumer looking for the best buy now, pay later app, or a business owner considering integrating these services, understanding the options available can help you make informed decisions.

Let’s delve into the world of buy now, pay later apps and discover the alternatives to Afterpay that could meet your needs.

Credit: itechnolabs.ca

The Rise Of Buy Now, Pay Later Services

The Rise of Buy Now, Pay Later Services

Consumer Shift Towards Flexible Payment

Consumers are increasingly gravitating towards flexible payment solutions, driving the popularity of apps like Afterpay. With the convenience and simplicity of buy now, pay later services, shoppers can spread their payments over time, making high-ticket items more affordable. This shift in consumer behavior reflects a desire for financial flexibility and the ability to manage expenses in a more manageable manner.

Impact On Retail And E-commerce

The rise of buy now, pay later services has transformed the retail and e-commerce landscape. Merchants who integrate these payment options into their checkout process often experience an uptick in conversion rates. By offering alternative payment methods, businesses can appeal to a wider consumer base and cater to individuals who prefer installment-based purchasing. This shift underscores the importance of adapting to evolving consumer preferences and embracing innovative payment solutions.

Credit: itechnolabs.ca

Afterpay’s Success Story

How Afterpay Changed The Game

Afterpay revolutionized the way people shop by offering a convenient and flexible “buy now, pay later” payment solution. By breaking down purchases into four interest-free installments, Afterpay empowered consumers to make purchases without the burden of upfront payments.

The platform’s seamless integration with online and in-store retailers made it a game-changer in the retail industry, attracting a vast user base and transforming the shopping experience for millions of customers.

Key Features Of Afterpay

- Interest-free installments

- Seamless integration with retailers

- Convenient payment solution

- Empowerment of consumers

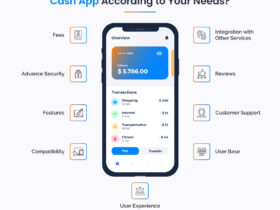

Criteria For Choosing A Bnpl Service

When selecting a BNPL service like Apps Like Afterpay, consider factors such as fees, payment flexibility, credit impact, customer service, and available retail partners. Compare the features and terms of different services to find the best fit for your needs and financial situation.

When it comes to selecting a Buy Now Pay Later (BNPL) service, there are several important criteria to consider. Making an informed decision will ensure that you choose the best BNPL service that suits your needs and preferences. Two key factors to evaluate are the interest rates and fees associated with the service, as well as the user experience and accessibility it provides. Let’s explore these criteria in more detail:

Interest Rates And Fees

One of the primary aspects to examine when comparing BNPL services is the interest rates and fees they charge. Understanding the financial implications of using a particular service is crucial to avoid unexpected expenses. Here are some factors to consider:

- Annual Percentage Rate (APR): A lower APR means lower interest charges over time, so it’s important to choose a BNPL service with competitive rates.

- Late Payment Fees: Some services may charge penalties for missed payments. Be sure to review the late payment fees and understand the consequences of not meeting your payment obligations.

- Additional Fees: It’s essential to check for any hidden fees or charges that may apply, such as transaction fees or membership fees. These can significantly impact the overall cost of using the BNPL service.

User Experience And Accessibility

The user experience and accessibility of a BNPL service can greatly affect your overall satisfaction and convenience. Consider the following factors when evaluating different options:

- Online Platform: A user-friendly website or mobile app makes it easy to manage your BNPL account, view transaction history, and make payments effortlessly. Look for services that offer intuitive interfaces and smooth navigation.

- Integration with Retailers: Check if the BNPL service is accepted by a wide range of online and physical stores. Having the flexibility to use the service wherever you shop allows for a seamless buying experience.

- Customer Support: Reliable and responsive customer support is crucial in case you encounter any issues or have questions about your BNPL service. Look for services that offer multiple channels of support, such as phone, email, and live chat.

By considering the interest rates and fees, as well as the user experience and accessibility, you can make an informed decision when choosing a BNPL service. Take the time to evaluate these criteria and select a service that aligns with your financial goals and preferences.

Credit: www.popsugar.co.uk

Klarna: A Global Payment Giant

Klarna, a leading global payment provider, has gained immense popularity in the world of online shopping. With its innovative and convenient payment solutions, Klarna has become a go-to option for consumers looking for an alternative to traditional payment methods. Let’s explore Klarna’s unique selling points and compare them with Afterpay, another well-known player in the market.

Klarna’s Unique Selling Points

1. Flexibility: Klarna offers flexible payment options that allow customers to split their purchases into manageable installments. This flexibility gives shoppers the freedom to buy what they want without the burden of paying the full amount upfront.

2. Global Reach: Klarna operates in multiple countries, making it accessible to a wide range of customers worldwide. This global presence enables shoppers to use Klarna’s services regardless of their location, making it a convenient choice for international online shopping.

3. Smooth User Experience: Klarna focuses on providing a seamless user experience, ensuring that the payment process is simple and hassle-free. With a user-friendly interface and intuitive features, Klarna aims to enhance the overall shopping experience for its customers.

Comparing Klarna With Afterpay

When it comes to comparing Klarna with Afterpay, there are some notable differences. While both offer buy now, pay later options, Klarna has a broader global reach compared to Afterpay, which primarily operates in Australia, the United States, and the United Kingdom.

Additionally, Klarna’s flexibility in allowing customers to split payments into installments sets it apart from Afterpay, which typically requires customers to make four equal payments over a specified period. Klarna’s payment options may vary, offering consumers more flexibility in managing their finances.

Moreover, Klarna’s smooth user experience and intuitive interface make it a preferred choice for many online shoppers. The convenience of using Klarna’s services across various online stores further adds to its appeal.

In conclusion, Klarna’s global presence, flexibility, and focus on user experience make it a significant player in the online payment industry. Whether you are looking to make purchases internationally or want more flexibility in your payment options, Klarna offers a robust solution that rivals Afterpay and other similar platforms.

Affirm: Transparent Credit Terms

Affirm offers transparent credit terms for apps like Afterpay, providing users with clear and understandable credit options. With Affirm, customers can make purchases and pay over time without the worry of hidden fees or confusing terms.

Why Affirm Stands Out

Affirm is a popular app like Afterpay that is known for its transparent credit terms. With Affirm, customers can easily split their purchases into manageable payments with clear and easy-to-understand terms. What sets Affirm apart from other similar apps is its focus on responsible lending and transparency.The Pros And Cons Of Using Affirm

Here are some of the advantages and disadvantages of using Affirm:Pros

- Transparent credit terms – Affirm clearly outlines all fees and interest rates upfront, so customers know exactly what they’re getting into.

- No hidden fees – Unlike some other financing options, Affirm does not charge any late fees or prepayment penalties.

- Easy approval process – Affirm’s approval process is quick and straightforward, with many customers receiving an instant decision.

- Flexible payment options – With Affirm, customers can choose to pay for their purchases over a period of three, six, or twelve months.

Cons

- High interest rates – While Affirm’s interest rates are transparent, they can be quite high compared to other financing options.

- Not available everywhere – Affirm is not available in all stores or for all purchases.

- May impact credit score – Like any form of credit, using Affirm can impact your credit score if you miss payments or are late with payments.

Paypal Credit: The Trusted Contender

PayPal Credit is a trusted contender among apps like Afterpay. With flexible payment options and secure transactions, it’s a popular choice for online shoppers.

Integrating Paypal Credit With Online Shopping

Looking for a reliable and trustworthy buy now, pay later (BNPL) app can be a daunting task, especially with so many options available in the market. However, if you’re looking for a trusted contender, then PayPal Credit is the way to go. As one of the most popular digital payment services, PayPal Credit offers a seamless and secure shopping experience, allowing customers to buy now and pay later.Benefits Over Other Bnpl Apps

One of the major benefits of using PayPal Credit over other BNPL apps is that it provides a flexible and affordable payment option. With PayPal Credit, you can make purchases and pay over time, without any interest if you pay in full within 6 months. Additionally, PayPal Credit offers a credit line of up to $10,000, so you can easily manage your expenses and budget. Another advantage of using PayPal Credit is its wide acceptance among online merchants. With millions of online retailers accepting PayPal, you can easily integrate PayPal Credit with your online shopping and make purchases with just a few clicks. Plus, PayPal Credit offers a mobile app, making it easy to manage your account and payments on the go. In conclusion, if you’re looking for a reliable and trusted BNPL app, then PayPal Credit is the way to go. With its flexible payment options, wide acceptance, and easy-to-use mobile app, PayPal Credit offers a seamless and secure shopping experience. So, next time you’re shopping online, consider using PayPal Credit and enjoy the benefits of buy now, pay later.Sezzle: The Up-and-coming Competitor

As the popularity of buy now, pay later (BNPL) services continues to soar, more and more consumers are seeking alternative options to traditional credit cards. One such up-and-coming competitor in the BNPL market is Sezzle. With its unique features and user-friendly experience, Sezzle is quickly making a name for itself as a viable alternative to popular platforms like Afterpay. Let’s take a closer look at Sezzle’s market position and user experience.

Sezzle’s Market Position

Sezzle has rapidly gained traction in the market, positioning itself as a strong competitor to Afterpay. The platform distinguishes itself by offering installment plans with zero interest and no additional fees, making it an attractive choice for budget-conscious shoppers. With a focus on affordability and transparency, Sezzle has successfully carved out a niche for itself in the crowded BNPL landscape.

Sezzle’s User Experience

Sezzle prides itself on providing a seamless user experience that prioritizes simplicity and convenience. The platform’s intuitive interface allows users to easily navigate through the buying process, making it effortless to split their purchases into manageable installments. Additionally, Sezzle offers a straightforward approval process, allowing users to quickly qualify for their desired spending limit.

One of the standout features of Sezzle is its instant approval decision, which provides users with immediate feedback on their eligibility. This real-time decision-making process eliminates the need for lengthy credit checks, ensuring a hassle-free experience for shoppers. Furthermore, Sezzle’s integration with numerous online retailers allows users to enjoy the benefits of the platform across a wide range of stores.

Sezzle also prioritizes transparency by clearly displaying repayment schedules and sending timely reminders to users. This proactive approach to communication helps customers stay on top of their payments and avoid any unexpected surprises. By promoting responsible spending and fostering trust, Sezzle aims to empower users to make informed financial decisions.

In conclusion, Sezzle is emerging as a strong competitor to Afterpay in the BNPL market. With its attractive zero-interest installment plans, user-friendly interface, and transparent approach, Sezzle offers a compelling alternative for consumers seeking flexible payment options. As the demand for BNPL services continues to grow, Sezzle’s unique features and commitment to user experience position it as a player to watch in the industry.

Zip (previously Quadpay): Flexible Payments

Zip, formerly known as Quadpay, offers a flexible payment solution for online shoppers. It allows users to split their purchases into four interest-free installments, making it a popular choice for those seeking alternatives to Afterpay. With its easy-to-use app and quick approval process, Zip provides a convenient way to manage payments.

Zip’s Approach To Bnpl

Zip, previously known as Quadpay, is a popular Buy Now Pay Later (BNPL) app that offers flexible payment options to consumers. With Zip, users can split their purchases into four equal installments, paid over a six-week period. This innovative approach to BNPL has made Zip a go-to choice for shoppers looking for convenient and budget-friendly payment solutions.

How Zip Differentiates Itself In The Market

Zip sets itself apart from other BNPL apps in several ways, making it a top competitor in the market. Here are some key differentiators:

- User-Friendly Interface: Zip’s app features a user-friendly interface that makes it easy for customers to navigate and manage their payments. The intuitive design ensures a seamless and hassle-free experience.

- Wide Range of Retailers: Zip has partnered with a diverse range of retailers, both online and offline, allowing users to make purchases from their favorite brands. This extensive network of retailers gives customers more options and flexibility in their shopping experience.

- No Hidden Fees: Unlike some other BNPL apps, Zip does not charge any hidden fees or interest on its installment payments. Customers only pay the original purchase amount divided into four equal installments, making it a transparent and cost-effective payment option.

- Instant Approval: With Zip, customers can get instant approval for their purchases, eliminating the need for lengthy credit checks or complicated application processes. This quick and convenient approval process enhances the overall shopping experience for users.

- Financial Responsibility: Zip encourages responsible spending and financial management by providing users with tools to track and manage their payments. Customers can easily monitor their spending, set payment reminders, and stay on top of their budget.

Overall, Zip stands out in the BNPL market due to its user-friendly interface, extensive retailer network, transparent fee structure, instant approval process, and emphasis on financial responsibility. These factors contribute to its popularity among users seeking flexible payment options for their purchases.

Future Of Bnpl Services

The Future of BNPL Services is an exciting and rapidly evolving landscape, with a myriad of innovative apps like Afterpay reshaping the way consumers approach payments. As technology continues to advance and consumer behavior shifts, the future of Buy Now, Pay Later (BNPL) services holds immense potential and opportunities for growth.

Trends To Watch In Bnpl

As BNPL services continue to gain popularity, several trends are emerging that are reshaping the industry. Increased adoption of BNPL by traditional retailers is one such trend, as more merchants integrate BNPL options into their checkout processes to cater to customer preferences and enhance the shopping experience.

Another significant trend is the expansion of BNPL into new markets and industries, including travel, healthcare, and education, offering consumers greater flexibility in managing their expenses across various sectors.

The Long-term Viability Of Bnpl Models

With the proliferation of BNPL services, questions arise regarding the long-term viability of these models. Sustainable risk management practices are crucial for the continued success of BNPL providers, ensuring responsible lending and minimizing default risks.

Moreover, strategic partnerships and collaborations between BNPL providers and financial institutions will play a key role in solidifying the long-term viability of these models, fostering trust and stability within the industry.

Frequently Asked Questions

Is There Another App Like Afterpay?

Yes, there are other apps similar to Afterpay such as Klarna, Affirm, Sezzle, and Quadpay.

Which Pay Later App Does Not Check Credit?

One pay later app that doesn’t check credit is Klarna. It offers a “Pay in 4” option where customers can split their payments into four installments. However, it’s important to note that Klarna may perform a soft credit check, which won’t affect credit scores.

Is Openpay The Same As Afterpay?

No, Openpay is not the same as Afterpay. While both are Buy Now Pay Later services, they have different features and payment options. Openpay allows for longer repayment terms and is available for larger purchases, while Afterpay focuses on smaller, interest-free installments.

Is Afterpay Or Sezzle Better?

Both Afterpay and Sezzle offer similar services, but the better option depends on your specific needs. Consider factors like fees, payment schedule, and available merchants to determine which one suits you best.

Conclusion

There are several great apps like Afterpay that offer similar services for consumers. These apps allow individuals to make purchases now and pay later, often with no interest. While each app may have its unique features, they all offer convenience and flexibility for shoppers.

It’s important to do your research and choose the app that best fits your needs and budget. With the rise of these apps, it’s clear that the “buy now, pay later” trend is here to stay.

Leave a Reply